My two latest blog posts have been about compound interest. I gave examples of interest rates of 6% up to 18% per year.

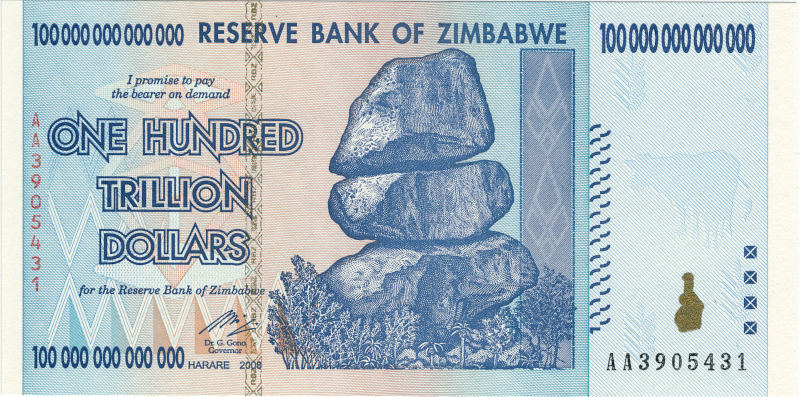

Hyperinflation, with rates of inflation in excess of 50% per month, changes everything. Although many economists accept 50% per month as the threshold of hyperinflation, the world has seen worse. Zimbabwe, for example, faced 98% inflation per day. With hyperinflation lots of implicit assumptions and approximations break down.

One take away from the previous posts is that at moderate interest rates, the frequency of compounding doesn’t make that much difference. A nominal interest rate of 12%, compounded continuously, is effectively a 12.75% interest rate. Compound less than continuously, say monthly or daily, and the effective rate will be somewhere between 12% and 12.75%.

But now say interest is 50% per month. Simple interest would be 600% a year, but nobody would accept simple interest. Compounded every month, the effective interest rate would be 12975%. Compounded daily it would be 38433%. And compounded continuously it would be 40343%.

In the numerical post, I said that the difference between continuous interest and interest compounded n times per year was approximately r² / 2n. That works fine when r is say 0.12. When r = 10 it’s off by two orders of magnitude. The implicit assumption that r² < r breaks down when r > 1.

Hyperinflation causes unusual behavior, such as paying for a meal before you eat it rather than afterward, because by the end of the meal the price will be appreciably higher.

What I find hardest to understand about hyperinflation is that people continue to use hyperinflated currency far longer than I would imagine. Once you start using a clock rather than a calendar when doing interest calculations, I would think that people would abandon the inflated currency in favor of something harder, like gold or silver, or even cigarettes. And eventually people do, but “eventually” is further out than I would imagine. It’s absurd to haul paper money in a wheel barrow, and yet people do it.

John, people do abandon hyperinflated currency very quickly and turn to hard currencies, like US dollar or gold, the only problem is that in most cases it is prohibited by the local law… I learned it hard way back in 1970/80s in Poland then ruled by communists and burdened by inflation of 100%/month: everybody used dollars (at least for larger purchases) risking bars.

It would be nice if governments followed mathematics-derived rules everywhere :)

Best,

Piotr

See the book “When Money Dies: The Nightmare of the Weimar Collapse” by Adam Fergusson for a historical recounting of people’s psychology during such times.